Colonel_Reb

Hall of Famer

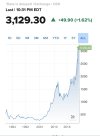

Considering the ever decreasing value of the US fiat $, you might think about investing in silver.

I found a pretty interesting article about recent trends and developments that might be of interest to some here.

http://news.silverseek.com/SilverSeek/1241716773.php

<center>Silver Leads Gold as Dollar Teeters</font></font>

By: Jim Willie CB</font></center>

Edited by: Colonel_Reb

I found a pretty interesting article about recent trends and developments that might be of interest to some here.

http://news.silverseek.com/SilverSeek/1241716773.php

<center>Silver Leads Gold as Dollar Teeters</font></font>

By: Jim Willie CB</font></center>

Edited by: Colonel_Reb